Investing in infrastructure companies is often tempting. The reason? Because many of the infrastructure companies are always available at attractive valuations. The reason for such lucrative valuation is again simple- investors have burnt their hands in infra companies and now swear to stay away forever. In the Indian context, infrastructure companies have been wealth destroyers. It is not uncommon to hear investors swearing not to ever again invest in the infrastructure sector! However, the current. government’s focus on developing world class infrastructure is again bringing back attention to this sector.

In this article, we try to understand one critical aspect of infrastructure projects, that Is often difficult to figure out. Infrastructure is surely a sector that has the potential to generate wealth in a developing economy. In this article, we will understand why infra is a classic cyclical sector and why it is important to get the time of your entry right in infra companies.

EPC stands for engineering, procurement and construction. In simple language, we can de-jargonize this and call them as infrastructure companies. There are various models in which infra companies operate, we will not delve deeper into each specific model. Rather, we’ll touch upon a relatively more important aspect called – ‘Percentage completion method’.

Let me give an example. Let us say National Highways Authority of India (NHAI) has awarded a project to an infra company to construct 100 km patch of a highway at a cost of Rs. 1000 crores. That works out to Rs. 10 crores per km. Assume this contract was given in 2021 and expected to complete by 2023.

Assume that to construct this piece of road, the infra company has to spend Rs. 800 crores. That simply means the company makes Rs. 200 crores profit on a top-line of 1000 crores. That’s a 20% profit margin for the company.

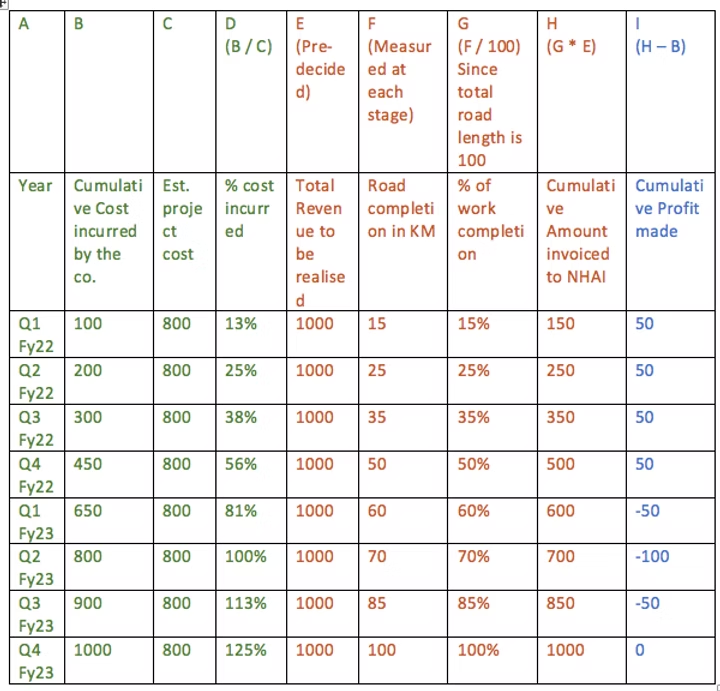

Please refer to the table given below.

You might stop reading the article after looking at the numbers. However, just please carry on. It is not difficult to understand. Let me explain these numbers in a simple manner.

Columns A,B,C,D are from the perspective of the infra company. Columns E,F,G,H are from the perspective of NHAI. Column I is from the perspective of investors.

In columns A-D, we are trying to calculate how much cost the company has incurred in each quarter. It is quite natural that the company incurs its costs based on how much it has spent by way of buying raw material, paying wages, managing liasoning expense etc. Very often, companies tend to overshoot the projected expenditure. This is exactly what we are saying in columns A-D. Toward the end, you’ll realise that the company ends up spending 25% more than the projected expenditure. This means the gross margin has turned negative for the company over the lifecycle of the project.

Coming to columns E,F,G,H. It is time to ask yourself a question- How will the NHAI do its accounting? Will they do it on the basis of how much cost the company incurs?

The answer is No! The NHAI is not bothered about how much money the company ends up spending. They simply want to see the output. Hence, they do their accounting on the basis of percentage of work actually completed. In our case, the work completion unit is KMs of road constructed. If the company constructs 10 KMs of road during a quarter, the client considers that the company has delivered 10% work during the quarter (Remember, that the total length of road to be constructed is 100 KMs)

Referring to column I, let’s understand what’s happening. Since the company is incurring costs earlier than recognising revenues, there are few quarters in which the company is reporting loss. If you add all the values of column I, you will see that the company has made neither profit nor loss. It is important to realise that despite not losing any money during the project, the profitability (gross margin) for the company has been extremely volatile!

How does this affect the performance of the company’s stock price? Firstly, the company was expected to make Rs. 200 crores over a period of 2 years. At the end of 2 years, the company makes no profit or no loss. While the company has not lost money on the project, it did appear over the lifecycle of the project that the company is losing money on the project. This is visible from the values of column I, when there were phases in which the company reported a loss. During such phases of loss, it is difficult for the investors to visualize how would such a project pan out for the company.

Secondly, there are multiple projects that a company undertakes simultaneously. The complexity of multiple such projects is not easy to decode.

Is there a way to find out the true state of profitability of an infrastructure company?

There is a way that can give some hint about what’s going on behind the scenes. When the company is invoicing the client, they are doing it as per their estimates of work completed. These estimates are based on how much cost is incurred by the company. However, as we have seen in the table above, the client has their own way of judging percentage work completion. This difference leads to something called as ‘unbilled revenue’.

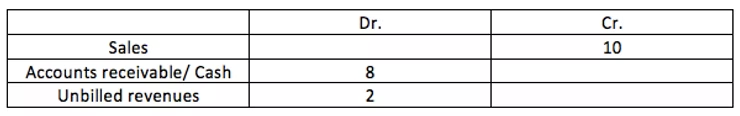

Let’s say the company accounts for Rs. 10 crores of revenues in a particular quarter. However, NHAI allows the company to invoice only Rs. 8 crores of revenues. This is how the accounting entry looks like:

As can be seen from the above table, there is a new account called ‘unbilled revenues’ that got created. Checking the balance on this account in a timely manner is likely to give some hint on how much trouble the company has ahead of them. Investors also can question the management on movements in the unbilled revenues account.

The question that now arises is ‘Can the company avoid putting entry into the unbilled revenues account?’ Well, the answer is Yes!

In order to avoid entry to the unbilled revenues account, the company has to invoice complete 10 crores to the client. However, the client would accept invoice only for Rs. 8 crores. This is where the company can play smart. They can create 2 invoices: One for Rs. 8 crores, which they submit to the client. The second invoice for Rs. 2 crores is created and kept back with the company. In the accounting system of the company, the entire Rs. 10 crores is recorded as revenues and the corresponding debit entry is shown to the accounts receivable account. In the eyes of investors, the company has reported more profits than the actual numbers. Please do note that this is mis-representation of facts and may give a big boost to the stock price!

Observing the movement in ‘accounts receivables’ account is important to ensure that the company is not realizing revenues aggressively. If you join the investor/ analyst calls for infrastructure companies, you would notice that analysts are generally interested in knowing the ‘aging’ analysis of ‘accounts receivable’ and ‘unbilled revenues’. If you notice that the management is not being transparent about these two accounts, this is a good enough red flag. Do note that there are some infra companies that are extremely transparent about their accounting. In my opinion, the stock prices of these companies might not be high-flyers, but it is always better to own infra companies having transparent accounting.

Other factors that makes infrastructure companies cyclical are:

- Winning new projects is dependent on many factors, the most important is government spending. If the government is nearing its fiscal deficit target for a given year, it is likely that spending will slow down. This affects revenues for most infrastructure companies.

- Gross margins of infra projects depend largely on raw material prices like cement, steel etc. These are commodities and their prices change on a regular basis. Unless, a company has signed an agreement for procuring raw material at a pre-decided cost, the gross margins are largely susceptible to fluctuations in raw material prices.

- Owing to changing gross margins, the company is prone to cost over-runs. As we have seen earlier, cost over-runs make it complicated for the management and investors to estimate the true profitability of a project.

- Too many loose ends leave ample scope for the management to tweak numbers as per the market sentiment. Let’s delve deeper into this. Assume the current sentiment in equity markets is extremely bullish with ample liquidity floating around. It’s quite obvious that all stocks including infra stocks are likely to do well. During such times, it is unlikely that the management of an infra company would spoil the party by reporting losses. Many companies tend to conduct aggressive accounting and show higher profits during bull markets. Similarly, the excessive profits booked during bull markets are reversed during bear markets. Promoter/ management often portrays such reversals as ‘one-off’ costs. However, the reality is that the true profitability/ gross margin was manipulated as per the phase of equity markets. This is the main reason why infrastructure stocks are hammered during bear markets. The excessive bullish sentiment during bull markets suddenly gets converted into extreme pessimism during bear markets.

- The cyclicality in govt. spending, raw material prices, and liquidity in stock markets makes it very difficult for minority investors to understand the true picture of profitability of infrastructure companies.

All these factors make infrastructure sector- a classic CYCLICAL!

Let’s conclude now? Infrastructure companies are difficult to analyze. There are many factors which make the sector very cyclical. Promoters can be innovative with accounting and have many opportunities at their disposal to play around with the stock price.

Does this mean one should never invest in infra companies. Well, that’s not what I am saying. However, it is surely better to pick infra stocks in a bear market than to buy during bull markets. If you can trust promoters of a particular company for their accounting, you may continue holding that company for the long term. Unfortunately, there are not many companies around which can be held perpetually.

Thanks for reading! Happy investing!